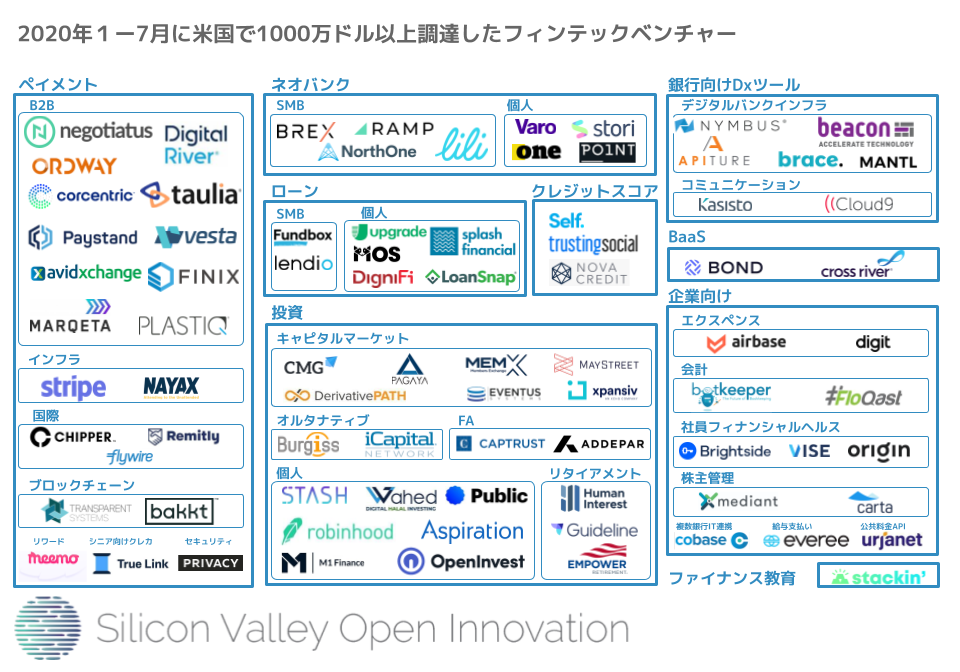

BCGの有名な「成長のマトリックス」でいえば、プラットフォーム事業(ソフトバンク・モバイルなど)は「キャッシュカウ」であり、そこで得たお金を破壊的事業という「スター、またはクエスチョンマーク」に投資し、当たり外れは大きいが当たれば(アリババのように)大儲けという仕組みですね。

では、ARMはどれに当たるでしょうか。売上が年率15%成長しており、健全なマージンがあり、そのままで「キャッシュカウ」としてしっかり稼いでくれそうです。また、ARMは非常に広範囲にわたる多数の顧客を持っており、既存のソフトバンクの事業と縦統合したり、ソフトバンク本体のために将来のプロダクト・ロードマップを変えるといったことをすれば、むしろ邪魔をすることになりそうです。このため、我々としては、ソフトバンクはARMを独立事業としてそのまま運営させるだろうと考えています。

ちなみに、スプリントはすでに大幅なテコ入れもなく「成り行きに任せる」経営のように見えますが、ターンアラウンドして高くして売ろうというつもりでなく、「キャッシュカウ」と思えばなるほど理解できます。しかし、無線通信キャリアには、必ず10年に一度「死の谷」が巡ってきます。次世代無線技術に対応するインフラ/周波数にアップグレードするためのまとまった設備投資の時期のことで、スプリントは「5Gに至る死の谷の時期」、2020年の少し前あたりが勝負になってくると思われます。

ところで、7月22日には、ジャパン・ソサエティとスタンフォード大アジア技術経営センターの共催による「Japan-US Innovation Awards」イベントが開催されました。ドロップボックスとメルカリが受賞したほか、いくつかの日本の技術ベンチャーも展示を行いました。ほとんどの出展者がなんらかの「モノづくり」に関わっているのが印象的でした。

海部

Friends,

So, like, SoftBank is buying ARM. We’ve gotten a fair bit of questions about this and so will comment here.

First and foremost, it can be helpful to think of SoftBank as an investment company that owns a telco, rather than a telco that makes investments. This is a key point of differentiation. There is no carrier in the US market that allows for an apples-to-apples comparison with SoftBank. T-Mobile has similar spectrum; Verizon has bought AOL and Yahoo and Millennial Media; but SoftBank is SoftBank. Sprint, while owned by SoftBank, is not like SoftBank.

SoftBank, in its guidance to investors on the acquisition (go here, accept the disclaimer, then read this deck), provides a deck that is worth reading. It clearly differentiates between its platform businesses (“operating assets”) and disruptive businesses (“investment assets”), as shown in the graphic here. Getting back to our point above, this is a portfolio manager perspective on businesses.

BCG’s 2x2 matrix (growth share matrix) on businesses, which segments businesses into cash cows, stars, question marks, and dogs, is another way to look at these. Platform businesses (cash cows): businesses that provide cash flow and are distribution platforms (read: SoftBank Mobile); and disruptive businesses (stars or question marks) are businesses with prospective exponential growth (read: Alibaba). As you might guess, disruptive, high growth businesses can turn into operational assets, and Yahoo Japan is an example of that within SoftBank’s portfolio.

So which is ARM? ARM’s revenue (about $1.5B in 2015, with operating profit of $500M) grew 15% YoY in 2014 and 2015. Healthy growth and margin that could produce “yield” for other businesses. (And certainly more yield than cash would get in Japan.)

ARM also serves a vast and diverse set of customers. Thus, vertical integration into SoftBank’s businesses, or altering its roadmap to favor SoftBank projects, could be counterproductive for the ARM business as a whole. Thus, it’s our view that SoftBank will support ARM’s operations as an independent company.

In other news, on Friday July 22 we attended the Japan-US Innovation Awards, presented by the Japan Society and Stanford’s Asia Technology Management Center. In addition to award recipients Dropbox and Mercari, the event featured anexcellent group of showcase companies visiting from Japan: Spiber (photo of prototype jacket for North Face), which makes spider-inspired biomaterials; Axelspace, which makes micro-satellites; Preferred Networks, which applies deep learning techniques in fields like robotics and automotive; Xenoma, makers of e-skin; and Floadia, makers of non-volatile memory. With the exception of Preferred Networks, all were hardware startups, broadly defined, and even Preferred serves a list of industrial customers such as Fanuc and Toyota.

Hardware is alive and well, apparently.

Onward!

- Team Blue Field